Copay And Deductible Template Letter

Your health insurance plan has a deductible of $5,000 with $10 copays for doctor visit and $5 copays for prescription medications. You've already paid $4,000 towards your deductible for the. Copays and deductibles are both features of most insurance plans. A deductible is an amount that must be paid for covered healthcare services before insurance begins paying. A letter to the payor should be provided outlining this policy. Alternatively, each claim should outline this policy. Another fairly safe course for a provider to take would be to reduce the co - payment o r deductible amount so that it is based on the total payment that the provider expects to. Difference between Copay and Deductible. Copay is the fixed amount that you have to pay towards your treatment. It can be a fixed amount per the nature of treatment of a fixed percentage. The deductible is the amount that you need to pay as a share towards your medical bill. Coverage Administration (i.e. Copay, deductible, etc.) 11.Maximum Reimbursable Amount. 12.Inpatient Facility Denial (Level of Care, Length of Stay). Based on medical necessity and other common administrative denials and supporting documentation and keep claim appeal letter templates that will help simplify your appeals process.

what is copay?Copayments are fixed dollar amounts (for example, $15) you pay for covered health service to the provider, usually when you receive the service.

Definition of terms: Copayment (copay): A predetermined fee for physician office visits, prescriptions or hospital services that the member pays at the time of service.

Medicare Definition

• A copayment amount for each service you get in an outpatient visit. For each service, this amount generally can’t be more than the Part A inpatient hospital deductible. If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed the Part A hospital stay deductible.

• All charges for items or services that Medicare doesn’t cover.

Example: Mr. Davis needs to have his cast removed. He goes to his local hospital outpatient department. The hospital charges $150 for this procedure. His copayment amount for this procedure, under the outpatient prospective payment system, is $20. Mr. Davis has paid $85 of his $155 Part B deductible. To have his cast removed, Mr. Davis must pay $90 ($70 remaining deductible amount + $20 copayment amount). The amount you pay may change each year. The amount you pay may also be different for different hospitals. Note: If you have a Medigap (Medicare Supplement Insurance) policy, other supplemental coverage, or employer or union coverage, it may pay the Part B deductible and copayment amounts

Medicaid Co-payments guidelines

Co-payment and co-insurance apply to clients covered by the Non-Traditional Medicaid Plan. Clients are required to make a co-payment for the types of services listed below. The provider is responsible to collect the co-pay at the time of service or bill the client. The co-payment shall be collected even if the client has other third party coverage. An exception to this policy is that co-payments are not taken out for Medicare Crossover claims.

Medicaid will automatically reduce the payments for each of these services by the indicated co-payment or coinsurance amounts at the time of reimbursement. The amount of the co-pay is described on the attached Benefit Chart for Non-Traditional Medicaid Plan.

• Hospital inpatient and non-emergency use of Emergency Department

• Outpatient hospital services, including free standing surgical center services

• Office visits for physician services, except preventive services and immunizations

• Vision care over $30 a year

• Pharmacy Services

• Physical Therapy

• Occupational Therapy

Co-pay Maximum Per Client

The out-of-pocket maximum is $15.00 per month for pharmacy co-pays. For inpatient procedures, the maximum is $220 per year. For physician and outpatient procedures, the combined maximum out-of-pocket is $100 per year

Which Providers can charge a Co-pay?

• Chiropractors

• Podiatrists

• Optometrists

• Physical, Occupational & Speech Therapists

• Hospitals (outpatient services except ER)

• Physicians & mid-levels (NP or PA)

• FQHCs & RHCs

How do I know to collect a Co-pay?

• First check eligibility on the participant to see if they are Medicaid eligible and co-pay exempt or not

– PORTAL

– EDI

– MACS

• Then determine whether or not the services you are about to render are subject to Co-pay by using this guide.

Who is exempt from Co-pay?

• A child with family income less than 133% FPG

• An adult with family income less than 100% FPG

• A pregnant or post-partum woman

• Children in foster care

• Those women who are eligible due to breast or cervical cancer

• Those on Hospice

• Those in Long Term care facilities

• Those on A&D or DD waiver

• Those who have primary insurance other than Medicaid

• Native Americans/Alaskan Natives

• Members who have reached a 5% CAP (a member who has paid out 5% or more of their monthly income is exempt for the remainder of the month)

• Workers with Disabilities Providers do not need to remember all these exemptions – the eligibility information provided by the system will reflect them.

What services can a provider charge a Co-pay for?

• Chiropractic services-services performed by a chiropractor.

• Podiatrist services-services performed by a podiatrist.

• Optometrist services- General Ophthalmological services billed by an Optometrist

• Physical, Occupational & Speech Therapy Services rendered in the therapist’s office or as an Outpatient hospital service

What services are subject to Co-pay?

• Outpatient Hospital –any of the services on this list performed in an outpatient hospital setting, except the emergency department

• Physician office visit-services provided at a doctor’s office unless preventive, family planning, or pregnancy-related.

• FQHC & RHC medical encounters, unless preventive, family planning, pregnancy-related or mental health.

Which Services are Co-pay exempt?

• Services performed in an Emergency room

• Services performed by an Urgent care clinic billing as an Urgent Care Facility

• Preventive services

• Family Planning

• Pregnancy related services

• Mental Health Services

• Services rendered that are $36.49 or less for the total claim.

What can I do if a participant doesn’t make their Co-pay?

What can I do if a participant doesn’t make their Co-pay?• You can refuse to render services

• You can waive the Co-pay but you must have a written policy documenting under what circumstances you will waive it

• You can bill the patient

• Whether or not you choose to charge a Co-pay, when both the participant and the visit is subject to Co-pay provisions, the Co-pay amount will be deducted from your reimbursement.

• Whether or not you choose to charge a Co-pay, when both the participant and the visit is subject to Co-pay provisions, the Co-pay amount will be deducted from your reimbursement.What about the 5% cost-sharing cap?

• The copay will be tracked against the CAP. It is possible the exempt status may not be triggered due to the timing of providers submitting claims. DHW will handle reimbursements to participants should this happen.

• How long will reimbursement to the participant take?

– The length of reimbursement time will vary depending on the situation. I.e. provider billing, number of visits.

How do I know if I have met my 5%

CAP for Co-pay?

• You must calculate your CAP using the income information you provided Medicaid to determine your eligibility.

• EXAMPLE ONLY: If your family income is $1,635.00 a month you would need to go to 22 qualifying appointments in a month to reach your CAP. (Use this guide to determine “qualifying” appointments)

(Calculation for example: $1635 x 5% = $81.75 (Max out-of-pocket (CAP)) $81.75 divided by $3.65 = 22 visits)

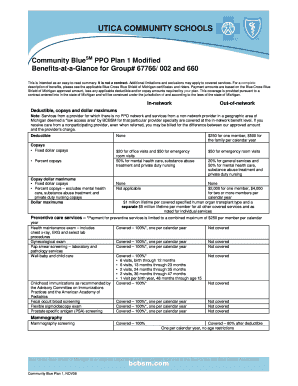

Copayment for commercial insurance

Its differ patient to patient and plan to plan. For example see the different type of plan or treatment and the copayment.

.

Why claims appeals are a critical practice component

DENIED CLAIMS APPEALS PROCEDURE

After completion of the retrospective review process contracting providers may appeal certain pre and post-service claim denials. Only claims denied as not medically necessary may be appealed on the provider’s own behalf as set forth in the policies and procedures. When BCBSKS requests records to support a claim denial, but does not receive them within the 45-day time limit, the service will be denied not medically necessary and will be a provider write-off. The provider may be designated as the member’s authorized representative for appeal purposes according to the terms of the member’s contract.

NOTE: Medical policies including Content of Service (COS) as described in BCBSKS Policy Memos 1-12 or provider’s obligations specified in their provider contracts are not considered eligible claims appeals as outlined in Section III. DENIED CLAIMS APPEALS PROCEDURE. Annually, BCBSKS outlines any changes to the Policy Memos and forwards them to providers for their review. Once providers accept these changes, they are part of the provider’s contract and therefore not considered for claims appeals. Providers disagreeing with any policies should submit their position and supportive documentation to BCBSKS staff for future consideration.

What is lost when practices do not appeal

Finding reasons for denial

Requests for an appeal should include:

Explain Copays And Deductibles

Ten important tips for appeal the denial claim

• Diagnosis changes/additions

• Date of service changes

Are Copays Included In Deductible

• Procedure code changes

• Unit changes

• Certain modifier changes/additions For a listing of proper reopening requests refer to https://www.noridianmedicare.com/je/partb/forms/nhs_reopen.pdf

How to Expedite Appeal Payment

In order to expedite the appeals process, ensure the request is complete and accurate. The following criteria are required on the Redetermination Request Form:

• Beneficiary’s full name

• Health Insurance Claim (HIC) number

• Date of service

• Signed Redetermination Request

• HCPCS/Procedure Code

Ensure all supporting documentation is submitted with your request. Refer to https://med.noridianmedicare.com/web/jeb/topics/appeals/documentation-requirements ) to determine the necessary medical documentation. CMS requires Noridian to order missing documentation via letter or a phone call to your facility. If all necessary documentation is not included in the request it could potentially delay your request an additional 14 days or longer. If no response is received

from Noridian’s request, your appeal will remain denied.

Ensure supporting medical documentation contains the following prior to submitting the request:

• Submit the request to the correct contractor

• Request is legible

• Correct date of service

• Valid medical documentation signatur

What is considered a Redetermination?

If a provider disagrees with Medicare’s decision on how a claim was initially processed, an appeal may be requested. Prior to submitting an appeal, consider if a

Telephone or Written Reopening could be requested.

How do I submit my Redetermination?

Submit redeterminations by one of the following:

Endeavor (FREE & Efficient):

https://med.noridianmedicare.com/web/jeb/topics/endeavor

Fax: 1-701-277-7852

Mail:

Noridian Healthcare Solutions

Attn: Redeterminations

PO Box (select from table on form)

Fargo ND 58108-(select from table on form)

Overpayment Redeterminations Mail:

Noridian

Attn: Overpayment Redeterminations

PO Box 6785

Fargo ND 58108-6785

RA Redeterminations Mail:

Noridian

Attn: RA Redeterminations

PO Box 6789

Fargo ND 58108-6789

Select the proper Type of Request such as CERT, Redetermination, Redetermination Due to Overpayment, RA or ZPIC on the Redetermination Form